(Reselling.news) eBay’s per-order fee increase is taking effect on March 15, 2024. According to the Winter 2024 Seller update, the per-order fee on orders over $10 will increase from $0.30 to $0.40 across all categories. “We’ve kept our per-order fee consistent since we started processing payments in 2020, but due to rising costs, we’re adjusting this fee. This change will enable us to continue to improve our marketplace so you and your buyers can have the best experience on eBay.”

eBay’s per-order fee increase may look minimal at first glance, but when you tally the amount of daily transactions, you can see how significant this increase is to the bottom line and shareholders.

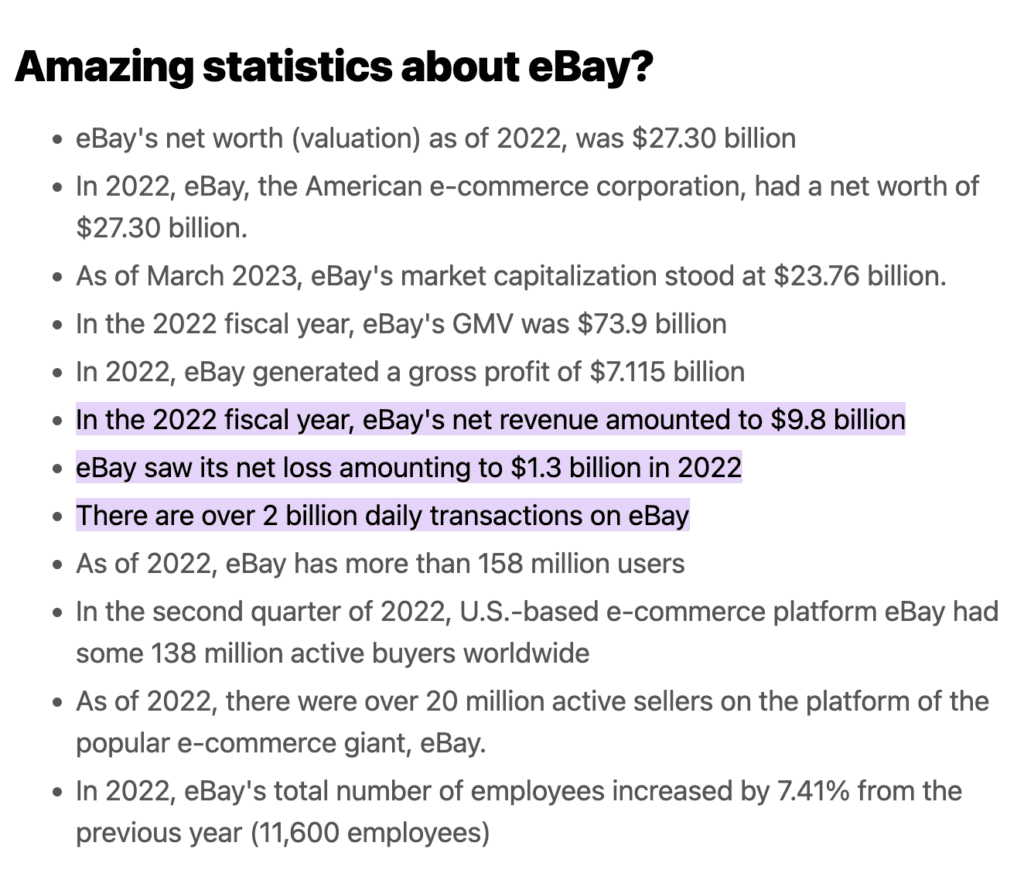

According to an analysis done by Sign House, eBay processed over 2 billion transactions per-day in 2022. Remember, the .10 cent fee increase only affects orders over $10.00. Since were unable to verify exactly how many transactions eBay makes over $10, I will be conservative in my calculations. For this analysis below I will estimate 25% of eBay’s transactions are over $10.

Daily transactions=2,000,000,000

Estimated daily transactions under $10.00=500,000,000

500,000,000 X .10 Cent fee increase=$50,000,000

50,000,000 X 365 Days in a year=$18,250,000,000

Hence, eBay stands to generate an additional $50 million per day and an estimated $18.25 billion annually due to this fee adjustment.

For your reference here is the full announcement from eBay:

Our per-order fee is changing

We’ve kept our per-order fee consistent since we started processing payments in 2020, but due to rising costs, we’re making an adjustment to this fee. This change will enable us to continue to improve our marketplace so you and your buyers can have the best experience on eBay.

What you need to know

Starting March 15, 2024, the per-order fee on orders over $10 will increase from $0.30 to $0.40 across all categories.

For example, if you sell a trading card for $25 including shipping and tax, you’ll now pay a fee of $3.71 instead of $3.61, an increase of $0.10.

We understand this change could impact the economics of selling lower-priced items. That’s why for orders $10 and under, there’ll be no change and you’ll continue to be charged the current rate of $0.30.

FAQs

What constitutes an “order”?

How are final value fees, including the per-order fee calculated?

We charge one final value fee when your item sells, and you don’t have to worry about third-party payment processing fees. This fee is calculated as a percentage of the total amount of the sale, plus a per-order fee of $0.40 for orders totaling over $10, or $0.30 for orders $10 and under.

The total amount of the sale includes the item price, any handling charges, any shipping costs collected from the buyer (some exceptions apply), sales tax, and any other applicable fees.

What do you think about Ebay’s per-order fee increase? Will this money be spent wisely? Let me know your thoughts in the comments below.

Sources for this article include:

Leave a Reply